Registration and customer service system

in the field of insurance

Challenge

Open Life was looking for a solution to support the sale and management of insurance policies for both individual customers and insurer partners.

One of the basic requirements was the ability to design and register new and modify existing insurance products without the need to engage an IT service provider. The solution also required integration with many of the Company’s internal systems.

Project parameters

- Analysis

- Product development

- Web development

- Integration with systems

- Integration Oracle BI Publisher

- Integration with MojeID

- API Sharing

- Development and maintenance

Solution

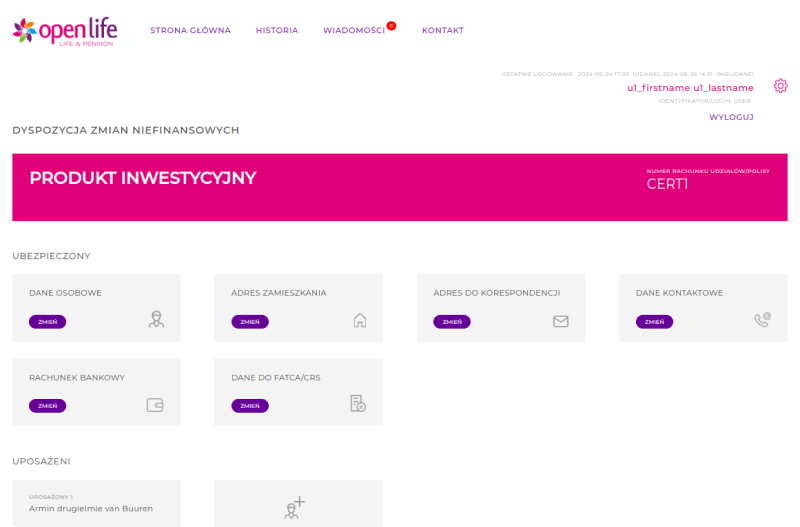

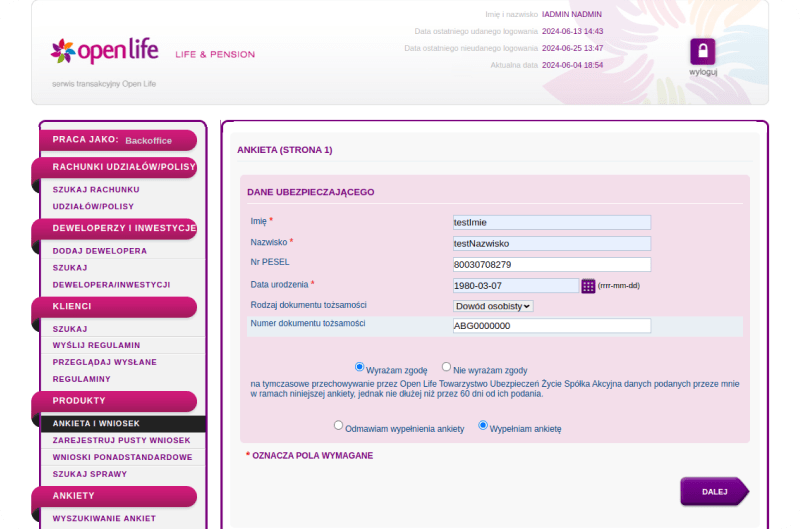

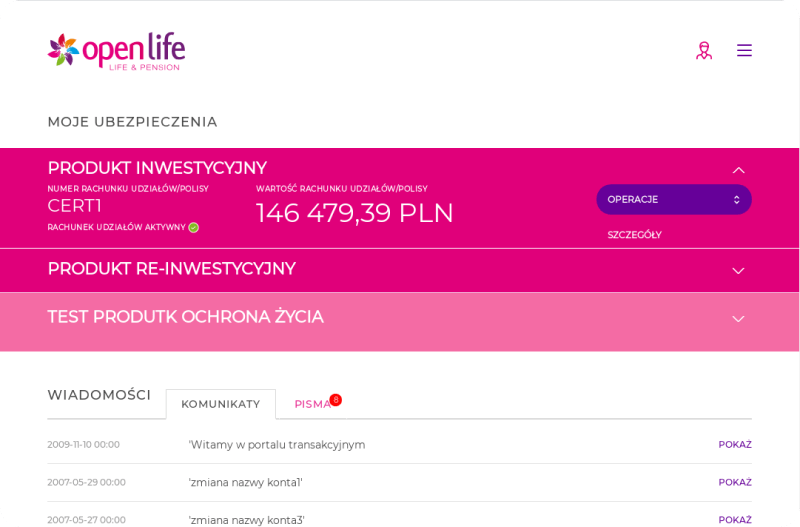

In response to the needs of Open Life, we have created a comprehensive, two-part IT system consisting of the Registrar (backend) and the Customer Portal (frontend). The InOut module has also been implemented, enabling data synchronization between Open Life systems.

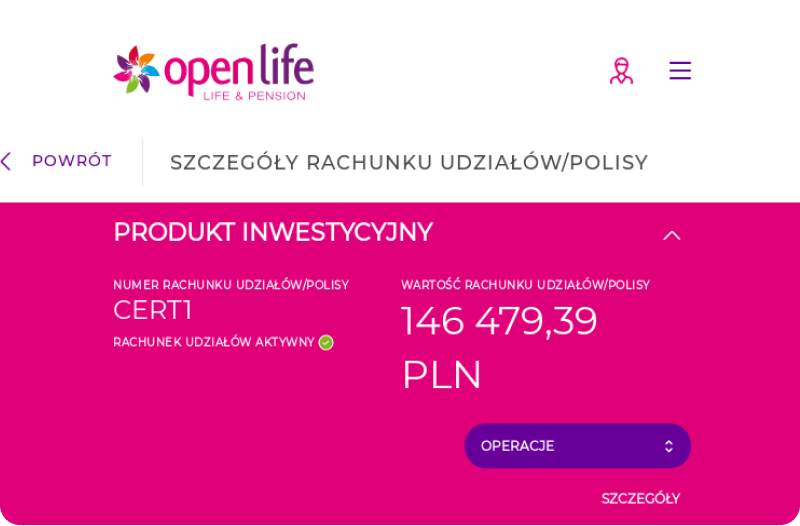

Our solution enables the sale and management of insurance via the Internet, including life, property and investment policies. The system also enables the sale and registration of products by Open Life partners, such as financial intermediaries and banks. The portal has been integrated with the Oracle BI Publisher printing system, MojeID and Open Life product systems. In accordance with the client’s requirements, the portals support responsive design (RWD).

The following modules were created as part of the solution we created:

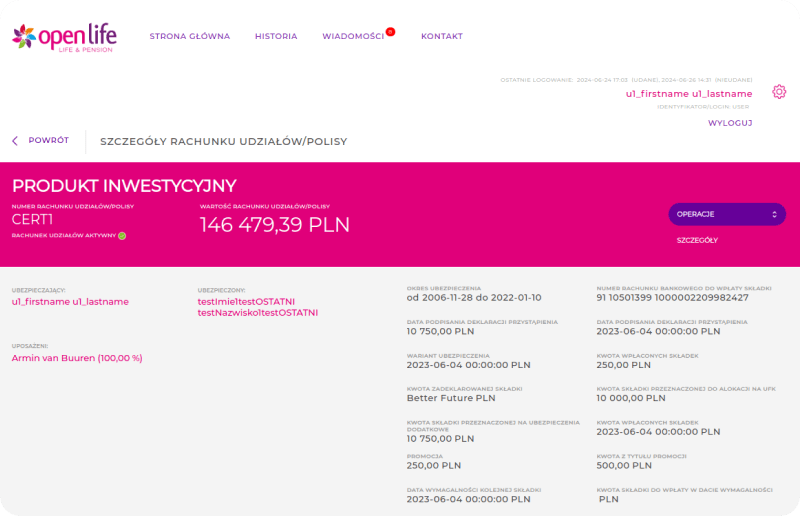

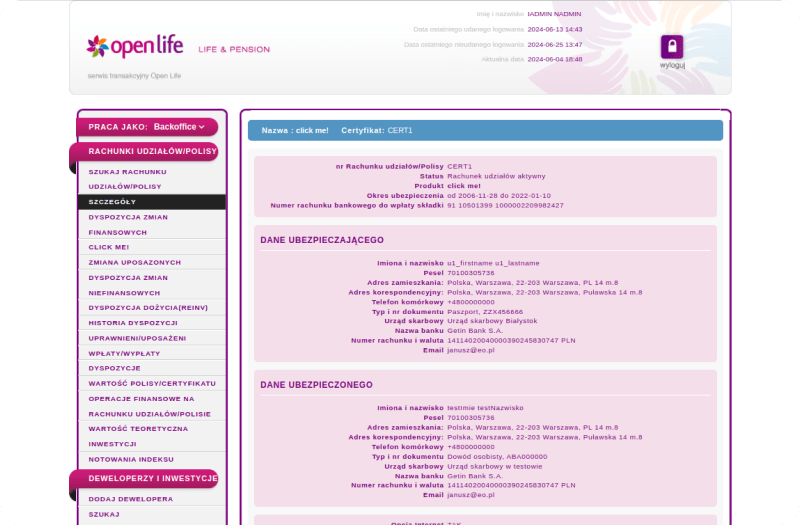

The module is available to both individual clients and intermediaries cooperating with Open Life. It allows clients to browse their policies, view funds, register and view the history of instructions. Intermediaries can search for their clients and manage policies on their behalf.

The module enables intuitive definition of products, including defining the application form and printout, as well as parameters such as the date of sale or documents related to the product. It also enables assigning the product to a specific intermediary, defining application statuses, and performing transition operations between statuses.

The module allows you to add intermediaries and their branches. It allows intermediary administrators to manage their own organizational structure, create branches and employees and give them appropriate permissions. The system also provides the generation of cyclical reports, such as sales statistics.

Since its implementation in 2012, we have been providing continuous maintenance and further development of the created portal. As part of the maintenance services, we guarantee mechanisms for automatic detection of vulnerabilities and library updates, which ensures the security and stability of the system.

The system we created for Open Life not only streamlined the sales and insurance management process, but also integrated various systems and modules into one coherent platform. Thanks to this, Open Life was able to increase operational efficiency and improve the quality of service for its customers and partners.

Design

Technologies

Java

Spring

Hibernate

Freemarker